VAT, GST and Sales Tax on Digital Goods - Adding your VAT or GST Number during Checkout or Requesting a Tax Refund

Digital VAT/GST or Sales Tax on digital services has been introduced in more than 40 countries around the world. In some countries it is applied to both private individuals (B2C) as well as customers registered as businesses/legal entities (B2B).

All prices listed on our site are in US Dollars and exclude any applicable VAT/GST which will be added during the checkout process.

For customers in the countries or US States listed on this page, FastSpring will charge VAT/GST on digital goods during the checkout process. For all new one-off transactions and new subscriptions, our order process is conducted by our online reseller Bright Market, LLC dba FastSpring. FastSpring is the Merchant of Record for all our orders and are responsible for issuing the VAT/GST invoices which you may require for tax purposes.

US Sales Tax Exemption

If a US customer is buying on behalf of an organization that is exempt from paying state and local sales taxes, FastSpring can refund the sales tax after the purchase has been completed. At this time, there is no way to prevent the sales tax from being collected on the order initially.

Customers can email a copy of their tax exemption certificate or other supporting paperwork issued by the state government to FastSpring via their web site, to https://questionacharge.com along with their order reference / order ID, and their support team will refund the sales tax back to the original payment account.

Adding your VAT/GST Number during Checkout

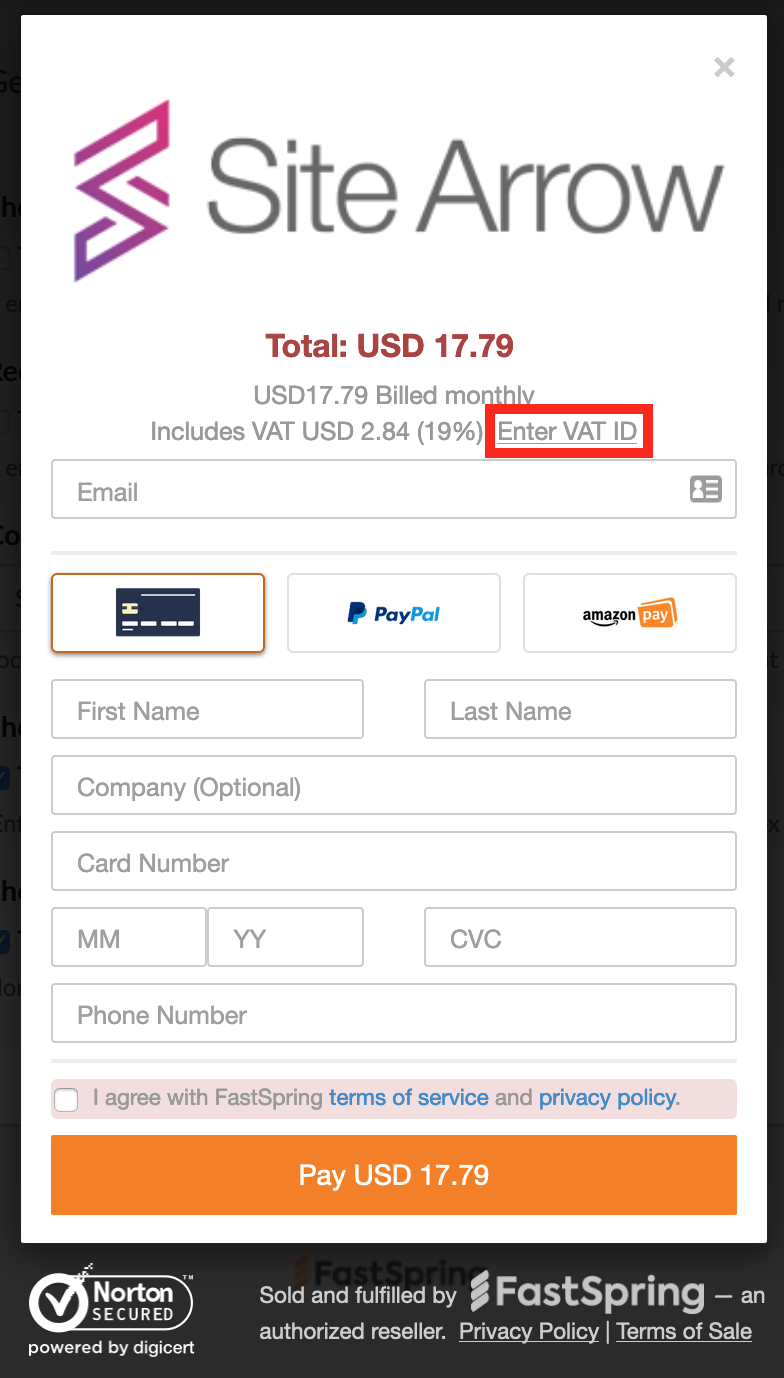

If you're eligible for a VAT/GST exclusion, you can click the "Enter VAT ID" link during the checkout process to enter your VAT details and exempt the transaction from the charge. See the image below to find where that link is (marked with a red box).

VAT/GST Refund

If you believe that you have been incorrectly charged for Sales Tax/VAT/GST or forgot to include your VAT/GST number during the checkout process, please contact FastSpring directly via their web site, to https://questionacharge.com with the order reference / ID and the valid VAT ID or GST ID and they will be able to verify your claim and issue a VAT refund to your original payment method if you are eligible.